Best Diversify Investment Portfolio for Stability in 2025

Investment in 2025 is about striking the perfect balance between risk and reward. Diversification remains the cornerstone of a resilient investment strategy, providing stability even in unpredictable markets. This comprehensive guide will show you how to build and manage a diversified portfolio, ensuring steady growth and minimizing risks.

Table of Contents

- Introduction: Why Diversification is Crucial

- Principles of a Diversified Investment Portfolio

- Risk Management

- Asset Allocation

- Periodic Rebalancing

- Top Asset Classes for Diversification in 2025

- Stocks

- Bonds

- Real Estate

- Cryptocurrencies

- Commodities

- Emerging Opportunities in 2025

- Renewable Energy

- Technology and AI

- Healthcare and Biotech

- Strategies for Building a Diversified Portfolio

- Tools and Resources for Managing Diversified Investments

- Common Mistakes to Avoid in Portfolio Diversification

- Conclusion: Embracing Stability and Growth in 2025

1. Introduction: Why Diversification is Crucial

Diversification involves spreading your investments across various asset classes, industries, and geographic regions. This strategy reduces the impact of a downturn in any single sector, ensuring that your portfolio remains stable even during market fluctuations. As global markets evolve, diversification becomes even more critical for long-term success.

2. Principles of a Diversified Investment Portfolio

a. Risk Management

Diversification helps manage risk by balancing high-risk, high-reward investments with stable, low-risk assets. This ensures that losses in one area are offset by gains in another.

b. Asset Allocation

Asset allocation is the process of dividing your investments among different asset categories. A well-balanced portfolio in 2025 might look like this:

- 40% Stocks

- 20% Bonds

- 20% Real Estate

- 10% Cryptocurrencies

- 10% Commodities

c. Periodic Rebalancing

Market fluctuations can alter your portfolio’s composition over time. Regular rebalancing ensures that your investments align with your original allocation and financial goals.

3. Top Asset Classes for Diversification in 2025

a. Stocks

Equities remain a key component of any diversified portfolio. In 2025, focus on:

- Growth Stocks: Companies in emerging sectors such as AI and green technology.

- Dividend Stocks: Provide steady income and stability.

- International Stocks: Exposure to fast-growing markets like India and Southeast Asia.

b. Bonds

Bonds offer stability and predictable returns. Options to consider include:

- Government Bonds: Low-risk investments backed by national governments.

- Corporate Bonds: Higher yields but slightly more risk.

- Municipal Bonds: Tax advantages for certain investors.

c. Real Estate

Real estate continues to be a solid investment, offering both income and capital appreciation. Explore:

- Residential Properties: Long-term rentals or short-term vacation rentals.

- Commercial Properties: Office spaces and retail hubs in growing cities.

- REITs: Real Estate Investment Trusts for easy access to property markets.

d. Cryptocurrencies

Digital currencies are increasingly becoming a staple in diversified portfolios. Focus on:

- Bitcoin and Ethereum: Proven track records.

- Emerging Altcoins: Such as Solana and Polygon for high growth potential.

- Stablecoins: To mitigate volatility while earning interest.

e. Commodities

Commodities provide a hedge against inflation and market instability. Key options include:

- Gold and Silver: Safe-haven assets.

- Energy Commodities: Oil, natural gas, and renewable energy resources.

- Agricultural Products: Wheat, soybeans, and corn.

4. Emerging Opportunities in 2025

a. Renewable Energy

With global emphasis on sustainability, renewable energy companies are poised for massive growth.

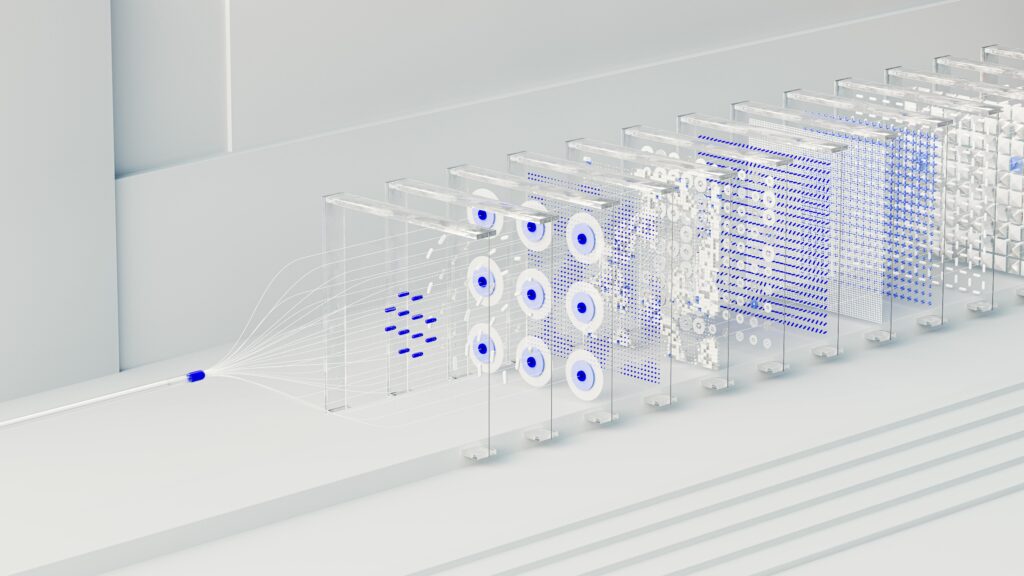

b. Technology and AI

AI is reshaping industries, creating investment opportunities in automation, robotics, and machine learning.

c. Healthcare and Biotech

Advances in gene therapy, telemedicine, and personalized healthcare are driving this sector forward.

5. Strategies for Building a Diversified Portfolio

- Assess Your Risk Tolerance: Determine how much risk you’re willing to take.

- Set Clear Goals: Define your short-term and long-term financial objectives.

- Start Small: Begin with core assets like ETFs and gradually expand.

- Use Dollar-Cost Averaging: Invest consistently over time to reduce market timing risks.

- Seek Professional Advice: Consult financial advisors for tailored strategies.

6. Tools and Resources for Managing Diversified Investments

- Portfolio Trackers: Personal Capital, Mint, and Morningstar.

- Investment Platforms: Fidelity, Vanguard, and eToro.

- Robo-Advisors: Wealthfront and Betterment for automated portfolio management.

7. Common Mistakes to Avoid in Portfolio Diversification

- Over-Diversification: Spreading investments too thin can dilute returns.

- Ignoring Correlations: Ensure assets in your portfolio don’t move in tandem.

- Failing to Rebalance: Regular adjustments are essential for maintaining your strategy.

- Neglecting Research: Always conduct due diligence before investing.

8. Conclusion: Embracing Stability and Growth in 2025